All Categories

Featured

Table of Contents

The are entire life insurance policy and global life insurance. grows cash worth at an ensured rates of interest and additionally through non-guaranteed rewards. grows money worth at a repaired or variable price, depending on the insurance company and policy terms. The cash money value is not contributed to the death benefit. Cash value is a feature you capitalize on while active.

The plan loan passion price is 6%. Going this route, the passion he pays goes back into his plan's cash value instead of a monetary establishment.

How Does Infinite Banking Work

Nash was a finance professional and fan of the Austrian college of business economics, which advocates that the worth of goods aren't explicitly the result of typical financial structures like supply and demand. Instead, people value cash and goods in a different way based on their financial standing and requirements.

One of the pitfalls of standard financial, according to Nash, was high-interest rates on car loans. Long as financial institutions set the passion rates and car loan terms, individuals really did not have control over their own wealth.

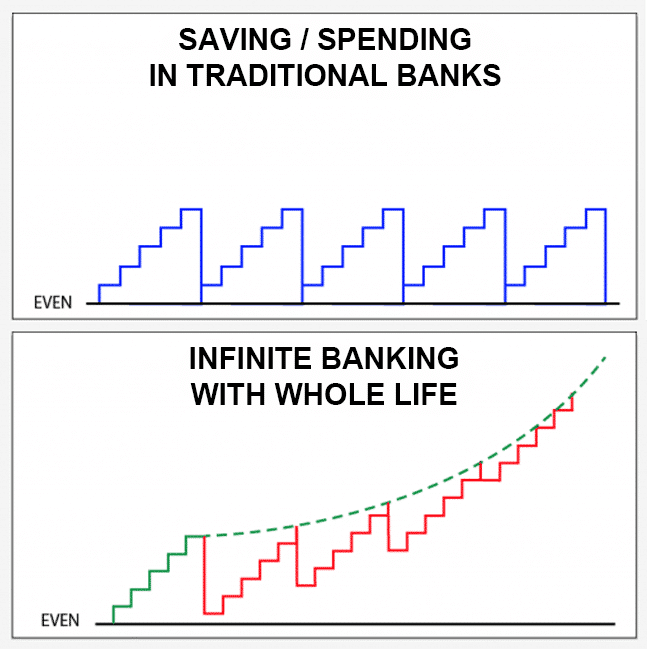

Infinite Banking requires you to own your financial future. For ambitious people, it can be the best financial tool ever before. Below are the advantages of Infinite Banking: Arguably the single most beneficial aspect of Infinite Banking is that it improves your money flow.

Dividend-paying entire life insurance policy is really reduced threat and provides you, the insurance holder, a terrific deal of control. The control that Infinite Banking offers can best be grouped right into two classifications: tax advantages and possession protections.

Rbc Private Banking Visa Infinite

When you use whole life insurance policy for Infinite Financial, you get in into a personal agreement in between you and your insurer. This privacy provides particular property securities not found in various other monetary cars. These protections may differ from state to state, they can consist of defense from asset searches and seizures, protection from judgements and protection from creditors.

Entire life insurance plans are non-correlated assets. This is why they work so well as the economic structure of Infinite Financial. No matter of what occurs in the market (stock, genuine estate, or otherwise), your insurance plan keeps its worth.

Whole life insurance coverage is that 3rd bucket. Not just is the price of return on your whole life insurance coverage policy assured, your fatality benefit and premiums are likewise ensured.

This framework aligns perfectly with the principles of the Perpetual Riches Method. Infinite Banking allures to those seeking greater financial control. Below are its major benefits: Liquidity and ease of access: Policy loans offer prompt access to funds without the restrictions of traditional bank financings. Tax obligation effectiveness: The cash money value expands tax-deferred, and policy finances are tax-free, making it a tax-efficient device for developing wide range.

Infinite Banking Review

Property defense: In lots of states, the cash value of life insurance policy is safeguarded from creditors, including an extra layer of economic protection. While Infinite Banking has its advantages, it isn't a one-size-fits-all service, and it includes substantial drawbacks. Below's why it might not be the very best technique: Infinite Banking typically needs elaborate policy structuring, which can confuse insurance holders.

Envision never having to fret regarding financial institution lendings or high passion rates again. That's the power of boundless banking life insurance.

There's no set lending term, and you have the liberty to select the settlement routine, which can be as leisurely as paying back the finance at the time of death. This adaptability encompasses the maintenance of the loans, where you can go with interest-only repayments, keeping the funding equilibrium flat and workable.

Holding money in an IUL fixed account being credited rate of interest can typically be better than holding the money on deposit at a bank.: You've always fantasized of opening your own pastry shop. You can obtain from your IUL plan to cover the initial costs of leasing a space, buying equipment, and employing personnel.

Bioshock Infinite Bank Cipher Book

Individual fundings can be obtained from typical financial institutions and debt unions. Obtaining cash on a debt card is generally very costly with yearly percentage rates of passion (APR) usually getting to 20% to 30% or even more a year.

The tax treatment of policy fundings can differ dramatically relying on your nation of home and the particular terms of your IUL plan. In some areas, such as North America, the United Arab Emirates, and Saudi Arabia, plan car loans are normally tax-free, supplying a significant advantage. Nonetheless, in various other territories, there may be tax implications to consider, such as prospective tax obligations on the financing.

Term life insurance only supplies a fatality benefit, without any kind of money value build-up. This suggests there's no money worth to obtain versus.

Nonetheless, for car loan police officers, the extensive laws enforced by the CFPB can be viewed as difficult and limiting. Initially, finance police officers frequently suggest that the CFPB's regulations develop unneeded red tape, leading to more paperwork and slower financing handling. Policies like the TILA-RESPA Integrated Disclosure (TRID) rule and the Ability-to-Repay (ATR) needs, while aimed at shielding consumers, can bring about delays in closing offers and increased functional prices.

Latest Posts

"Infinite Banking" Or "Be Your Own Bank" Via Whole Life ...

Infinite Banking Concepts

Ibc Whole Life Insurance